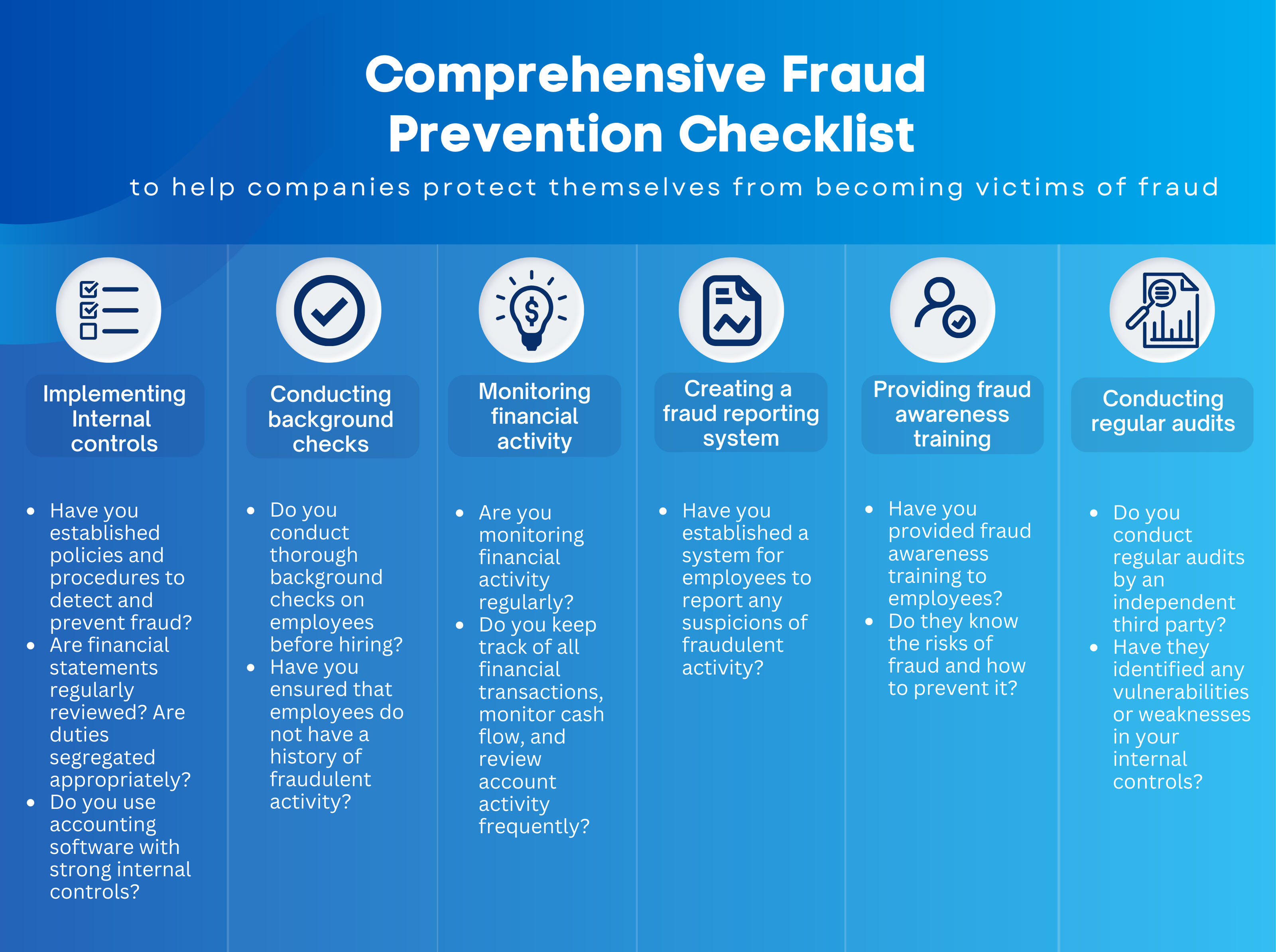

As a forensic accounting and auditing firm, we have seen far too many businesses suffer from fraud and financial crimes. That’s why we’ve created a comprehensive Fraud Prevention Checklist to help companies protect themselves from becoming victims of fraud.

As a company, have you taken steps to prevent fraud and financial crimes? Here are some questions to consider:

Implementing internal controls

- Have you established policies and procedures to detect and prevent fraud?

- Are financial statements regularly reviewed? Are duties segregated appropriately?

- Do you use accounting software with strong internal controls?

Conducting background checks

- Do you conduct thorough background checks on employees before hiring?

- Have you ensured that employees do not have a history of fraudulent activity?

Monitoring financial activity

- Are you monitoring financial activity regularly?

- Do you keep track of all financial transactions, monitor cash flow, and review account activity frequently?

Creating a fraud reporting system

- Have you established a system for employees to report any suspicions of fraudulent activity?

Providing fraud awareness training

- Have you provided fraud awareness training to employees?

- Do they know the risks of fraud and how to prevent it?

Conducting regular audits

- Do you conduct regular audits by an independent third party?

- Have they identified any vulnerabilities or weaknesses in your internal controls?

At Integrity Forensic, we understand the importance of preventing fraud and financial crimes. Our Fraud Prevention Checklist covers all the essential elements of a robust fraud prevention program. Contact us today to learn more about how we can help you protect your business against potential fraud. Call now for a free consultation at 855-673-9999 or send us a message at questions@integrityforensic.com.