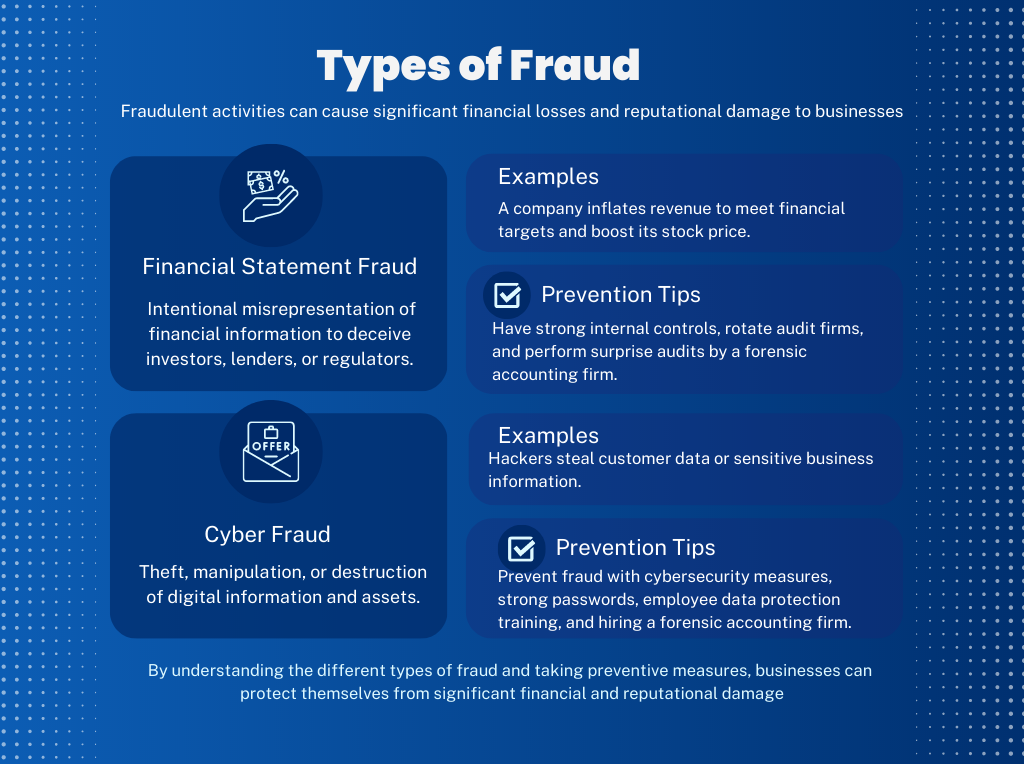

Detecting and preventing fraud early is crucial for businesses to safeguard their financial stability and reputation. By understanding the various types of fraud that exist, organizations can take proactive measures to mitigate the risks. In this blog post, we will explore two additional types of fraud – financial statement fraud and cyber fraud – and provide valuable prevention tips to help businesses protect themselves.

- Financial Statement Fraud – Maintaining Integrity in Financial Reporting

Financial statement fraud involves intentionally misrepresenting financial information to deceive stakeholders, such as investors, lenders, or regulators. This deceitful act is often aimed at manipulating financial performance indicators. To prevent financial statement fraud, consider implementing the following tips:

Strong internal controls: Establish robust internal controls to ensure accurate financial reporting and detect any discrepancies. This may include segregation of duties, regular monitoring of financial activities, and implementing a whistleblower hotline for reporting suspicious behavior.

Rotate audit firms: Regularly rotate audit firms to maintain independence and objectivity in the auditing process. This helps minimize the risk of collusion between management and auditors that could facilitate fraudulent activities.

Surprise audits by forensic accounting firms: Conduct surprise audits by engaging a reputable forensic accounting firm. These experts specialize in detecting and investigating financial irregularities, providing an additional layer of assurance against fraudulent practices.

- Cyber Fraud – Safeguarding Digital Assets

Cyber fraud involves the theft, manipulation, or destruction of digital information and assets. With the increasing reliance on digital platforms, businesses must be proactive in protecting themselves from cyber threats. Consider the following prevention tips:

Cybersecurity measures: Implement robust cybersecurity measures, such as firewalls, encryption, and intrusion detection systems, to protect sensitive data from unauthorized access. Regularly update software and conduct vulnerability assessments to identify and address potential weaknesses.

Strong passwords and access controls: Enforce strong password policies and multi-factor authentication to prevent unauthorized access to systems and sensitive information. Regularly review and update user access rights to ensure appropriate levels of authorization.

Employee data protection training: Educate employees on best practices for data protection, including identifying phishing attempts, avoiding suspicious links or downloads, and practicing secure data handling procedures. Regular training sessions help create a culture of cybersecurity awareness within the organization.

Engage a forensic accounting firm: Consider partnering with a forensic accounting firm that specializes in cyber fraud prevention and detection. They can assess your digital infrastructure, conduct risk assessments, and help develop strategies to enhance cybersecurity.

In conclusion, by understanding the various types of fraud and implementing preventive measures, businesses can significantly reduce the risks associated with fraudulent activities. Maintaining integrity in financial reporting and safeguarding digital assets are essential components of a robust fraud prevention strategy. Consider partnering with a forensic accounting firm to benefit from their expertise and ensure your organization’s financial stability and reputation. Stay vigilant, stay informed, and protect your business from fraud.

At Integrity Forensic, we have a team of experienced forensic accountants to assist you. Call now for a free consultation: 855-673-9999 or send us a message at questions@integrityforensic.com.