Safeguarding Organizations Against Rising Fraud

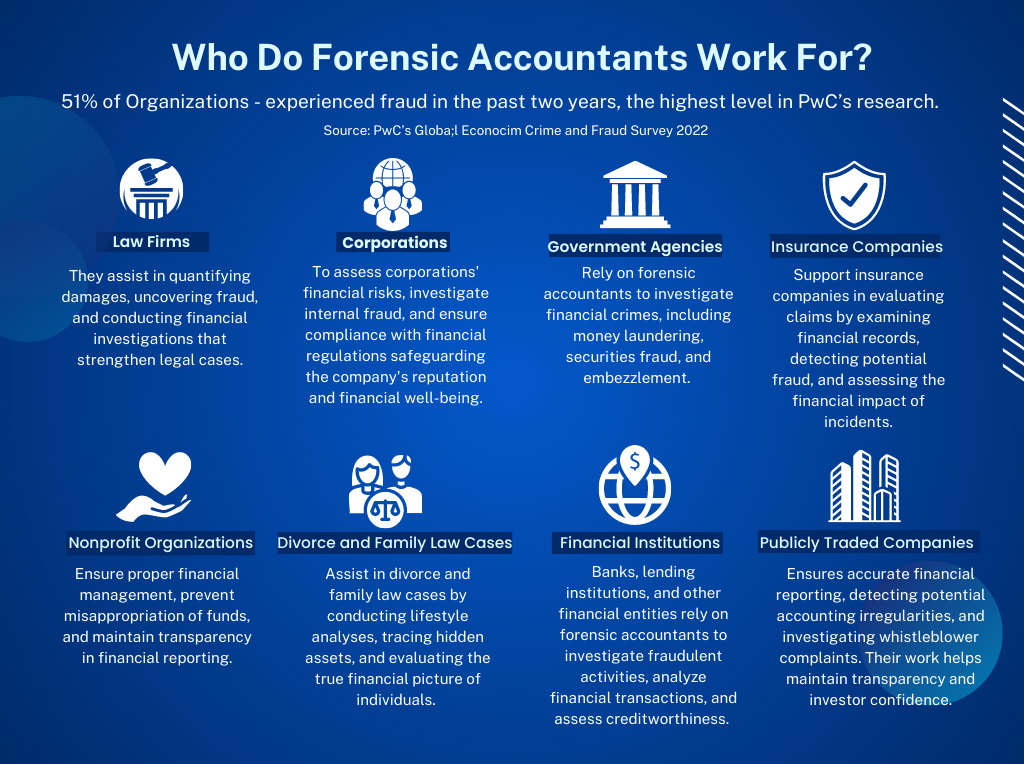

In today’s complex financial landscape, organizations face significant risks from fraud and financial irregularities. The need for diligent and skilled professionals to unravel financial mysteries has never been greater. Enter forensic accountants – the financial detectives armed with investigative expertise and analytical acumen. In this blog, we will explore the diverse roles and industries that rely on the invaluable services of forensic accountants. Moreover, we will delve into the alarming rise in fraud incidents, as evidenced by PwC’s recent research revealing that 51% of organizations experienced fraud in the past two years – the highest level recorded. Let’s uncover how forensic accountants play a pivotal role in safeguarding organizations and combating this growing threat.

Law Firms: Providing Litigation Support and Financial Expertise

Forensic accountants are sought-after allies for law firms. They contribute critical financial expertise and litigation support, aiding in quantifying damages, unearthing fraudulent activities, and conducting in-depth financial investigations. Their meticulous analysis of financial records and expertise in navigating complex financial transactions bolster legal cases and enhance the pursuit of justice.

Corporations: Safeguarding Financial Integrity and Detecting Internal Fraud

In an era where corporate scandals and financial misdeeds can wreak havoc on a company’s reputation, forensic accountants serve as a line of defense. They assist corporations in assessing financial risks, investigating internal fraud, and ensuring compliance with regulatory frameworks. By deploying advanced forensic techniques, they identify fraudulent activities, safeguard financial integrity, and protect shareholders’ interests.

Government Agencies: Upholding Financial Integrity and Combatting Financial Crimes

Government agencies, including regulatory bodies and law enforcement agencies, rely on forensic accountants to combat financial crimes that threaten economic stability. With their deep understanding of financial systems and their ability to follow the money trail, forensic accountants play a vital role in investigating money laundering, securities fraud, and embezzlement. Their work helps uphold financial integrity, enforce compliance with financial laws, and preserve public trust.

Insurance Companies: Detecting Fraudulent Claims and Mitigating Risk

Insurance fraud poses a significant threat to the insurance industry. Forensic accountants provide indispensable support to insurance companies by meticulously examining financial records, detecting potential fraud indicators, and evaluating the financial impact of reported incidents. By leveraging their expertise, they help insurance companies detect and prevent fraudulent claims, ensuring fair settlements and reducing financial losses.

Nonprofit Organizations: Ensuring Transparency and Accountability

Nonprofit organizations face unique financial challenges, as they rely heavily on donations and grants. Forensic accountants assist nonprofits in managing finances effectively, preventing misappropriation of funds, and ensuring transparency in financial reporting. By implementing robust internal controls and conducting thorough audits, forensic accountants protect donor investments and contribute to maintaining public trust.

Divorce and Family Law Cases: Unveiling Hidden Assets and Ensuring Fair Settlements

Divorce proceedings often involve complex financial matters and disputes over asset division. Forensic accountants play a crucial role in these cases by conducting lifestyle analyses, tracing hidden assets, and evaluating the true financial picture of individuals. Their expertise helps ensure fair settlements and equitable distribution of assets, providing clarity and supporting the pursuit of justice.

Financial Institutions: Safeguarding Against Fraud and Assessing Creditworthiness

Banks, lending institutions, and other financial entities rely on forensic accountants to protect themselves and their customers from financial fraud. By investigating fraudulent activities, analyzing complex financial transactions, and assessing creditworthiness, forensic accountants identify potential risks and help safeguard the financial institutions’ interests. Their work contributes to maintaining financial stability and customer confidence.

Publicly Traded Companies: Ensuring Accurate Financial Reporting and Transparency

Forensic accountants play apivotal role in supporting publicly traded companies by ensuring accurate financial reporting and maintaining transparency. They assist in detecting potential accounting irregularities, investigating whistleblower complaints, and conducting thorough audits. By upholding the highest standards of financial integrity, forensic accountants contribute to investor confidence and ensure compliance with regulatory requirements.

The Alarming Rise in Fraud Incidents:

In recent years, fraud incidents have witnessed an alarming surge, posing a significant challenge for organizations across industries. PwC’s research reveals a staggering statistic – 51% of organizations experienced fraud in the past two years, marking the highest level recorded. This trend highlights the pressing need for organizations to fortify their defenses against fraudulent activities and seek the expertise of forensic accountants.

The forensic accounting profession plays a crucial role in addressing this growing threat by deploying specialized techniques and methodologies. These experts diligently examine financial records, follow the money trail, and scrutinize intricate transactions to detect signs of fraudulent activities. By analyzing financial data and conducting comprehensive investigations, forensic accountants help organizations identify vulnerabilities, implement robust internal controls, and develop proactive strategies to mitigate the risks associated with fraud.

The combination of technological advancements, complex financial systems, and evolving fraudulent schemes necessitates the continuous evolution of forensic accounting techniques. Forensic accountants harness advanced data analytics, forensic software, and digital forensic tools to uncover hidden patterns and detect anomalies. They collaborate with IT experts and cybersecurity professionals to combat the rising tide of cybercrime and digital fraud.

Moreover, forensic accountants play a crucial role in providing training and education to organizations, enhancing their understanding of fraud prevention, detection, and response. By equipping internal teams with the necessary knowledge and skills, forensic accountants empower organizations to build a robust anti-fraud culture and protect themselves against financial risks.

In a world grappling with rising fraud incidents, forensic accountants serve as beacons of integrity, expertise, and justice. Their multifaceted roles span across diverse industries and sectors, from supporting legal cases to uncovering internal fraud within corporations. As organizations face the daunting challenge of combating fraud, forensic accountants stand as indispensable allies, armed with their deep financial acumen and relentless pursuit of truth. By working diligently to unravel financial mysteries, they safeguard organizations, protect stakeholders, and preserve financial integrity in an increasingly complex financial landscape.

At Integrity Forensic, we have a team of experienced forensic accountants to assist you. Call now for a free consultation: 855-673-9999 or send us a message at questions@integrityforensic.com.